Ever feel like HELOC payments are a mystery wrapped in a riddle? You’re not alone. Plenty of homeowners are blindsided by fluctuating payments, leading to financial anxiety that sneaks up like a surprise bill in the mail. The ever-changing nature of interest rates and shifting balances can feel like trying to hit a moving target. But here’s the thing—once you break it down, the math behind HELOC payments isn’t as intimidating as it seems. This guide cuts through the fog, giving you a clear-cut approach to managing your payments with confidence.

A No-Nonsense Method for HELOC Payment Calculation

Numbers don’t lie, but they can definitely confuse. Whether your HELOC is interest-only or amortizing, the key to control is understanding the math. Let’s simplify it into bite-sized steps, so you don’t need a finance degree to get ahead.

The Formula Breakdown (Without the Headache)

So, how to calculate home equity line of credit payment?

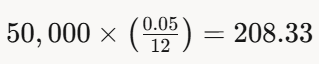

For Interest-Only HELOCs:

At its core, the formula is refreshingly simple:

Example: A $50,000 balance at a 5% interest rate? Your monthly payment would be:

Just covering interest—nothing more. Simple, right? But it gets trickier when you start paying down the principal.

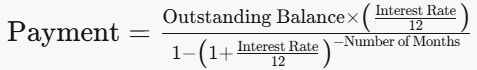

For Amortizing HELOCs:

Here, things ramp up. Now you’re paying off both interest and principal, and the formula looks more like this:

It’s a bit of a beast, but don’t let it scare you. Plugging in the numbers does the heavy lifting for you. This method takes the guesswork out of payments, keeping you in the driver’s seat.

Why This Approach Works

It’s not just about running numbers—it’s about taking charge. When you know exactly what’s coming each month, you dodge financial curveballs and plan ahead. The real win? No more budget surprises. Just control, clarity, and confidence in your financial future.

What Really Affects Your HELOC Payment?

HELOCs are a balancing act. Two major players determine your payment:

1. Interest Rates: The Sneaky Payment Changer

Since most HELOCs have variable rates, your payment isn’t set in stone. Even a small increase can shake things up. Take a look:

| Interest Rate | Monthly Payment ($50,000 Balance) |

|---|---|

| 5% | $208.33 |

| 6% | $250.00 |

| 7% | $291.67 |

That jump from 5% to 6%? It adds $41.67 to your monthly bill—money you probably don’t want to scramble for.

2. Your Balance: A Constantly Moving Target

Unlike a regular loan, a HELOC balance changes as you borrow or pay down debt. Example:

- $100,000 balance at 5% → $416.67 monthly

- Pay down to $80,000 → $333.33 monthly

- Borrow back up to $90,000 → $375.00 monthly

That flexibility is great—until you lose track of what you actually owe.

Smart HELOC Management: The Key to Debt Control

You’ve got the math down, but how does this help you make smarter financial moves?

1. Understanding Interest-Only vs. Amortizing Payments

- Interest-Only: Keeps monthly costs low, but the full balance still looms. Great if you need breathing room.

- Amortizing: Higher payments, but steady progress toward getting debt-free.

It all comes down to your financial goals. Want lower payments now? Go interest-only. Want to clear debt faster? Amortize.

2. Budgeting Like a Pro

HELOCs don’t always play nice with rigid budgets, so you need a game plan:

✅ Set aside extra cash for sudden interest hikes.

✅ Pay on time to protect your credit score.

✅ Plan ahead if you’re on an interest-only plan—you’ll eventually owe the principal!

When you stay ahead of the game, your HELOC becomes a financial tool, not a trap.

Time to Take Control

You’ve got the knowledge—now use it. Run the numbers, tweak your budget, and turn your HELOC into an asset rather than a financial burden.

Still have questions? Dive into our other guides or drop your email above for exclusive strategies to secure $50K–$150K in unsecured capital at 0% interest. The next move is yours—make it count.