We help seasoned and beginner real estate investors by providing short-term mortgage solutions to acquire fix and flips, rental properties, rehab, or refinance commercial properties all across the United States

Email us at kusuma@getlineofcredit.com with the answers to these questions and we will give you a quick estimate:

- Do you currently have a specific real estate project (acquisition or refinance) you are looking to fund?

- Yes, I have a property identified or under contract.

- No, but I am actively looking for a property.

- Not currently, just exploring options.

- What is the property address, and what type of property is it (e.g., Single Family Home, Multi-Family with X units, Retail, Office, etc.)?

- Single Family (non-owner occupied), Duplex, Triplex, Fourplex, Retail, Office, Warehouse.

- Multi-Family with 5+ units, certain special-use properties.

- Owner-occupied residence, Raw vacant land, Rural property.

- Property with known “funky” issues (built on multiple lots, shared lot with other homes, former non-standard use like office converted from residential in a non-commercial zone).

- How soon do you need to close on this project?

- Within 3-7 days

- Within 2-4 weeks

- More than 4 weeks / No strict timeline

- What is your estimate of your middle credit score?

- 650 or higher

- 600 – 649

- 550 – 599

- Below 550

- Prefer not to say / Don’t know

- How many investment properties (specifically fix-and-flip if that’s the deal type) have you successfully closed in the last 3 years?

- 3 or more

- 1-2

- None / This is my first deal

- What amount of liquid assets do you have available (e.g., in a bank account)?

- Enough to cover estimated closing costs, required down payment/equity, AND 6-8 months of estimated loan payments as reserves

- Enough for closing costs/down payment, but tight on reserves

- Insufficient funds to cover estimated closing costs and down payment

- For an acquisition: What is the purchase price, your estimated rehab cost, and what do you believe the After-Repair Value (ARV) will be? OR For a refinance: What is the estimated current value of the property and the amount owed on existing mortgages?

- Acquisition: ARV calculation shows the required loan amount (Purchase + Rehab) is well within the lender’s max LTV (e.g., Purchase + Rehab < 70% of estimated ARV) AND Rehab cost is reasonable relative to Purchase Price.

- Acquisition: ARV calculation shows the required loan amount is near the max LTV (e.g., Purchase + Rehab is between 70-75% of estimated ARV) OR Rehab cost is high relative to Purchase Price.

- Acquisition: ARV calculation shows the required loan amount exceeds the lender’s max LTV OR Rehab cost outweighs the Purchase Price.

- Refinance: Estimated value shows significant equity to support the desired loan amount within LTV limits (e.g., desired loan amount < 60-80% of estimated value).

- Refinance: Estimated value shows limited equity, meaning the desired loan amount is near or exceeds max LTV.

Beyond these initial questions, please send these information to speed things up:

- Preliminary Loan Application (ask us on email)

- Executed Purchase Agreement (if applicable)

- Detailed Rehab List (if applicable)

- Current Photos (Interior & Exterior)

- Three Comparable Sales (Comps)

- Addresses of Past Investment Properties (if applicable)

- Proof of Funds/Bank Statements (usually 3 months)

Real Estate Loans – Frequently Asked Questions

- Where can I submit a loan scenario? Via e-mail to kusuma@getlineofcredit.com

- Where do you offer financing? In all 50 states, in areas that are not too rural. International financing is not available.

- What type of properties do you finance? Single-family homes, multifamily, condos, townhouses, offices,

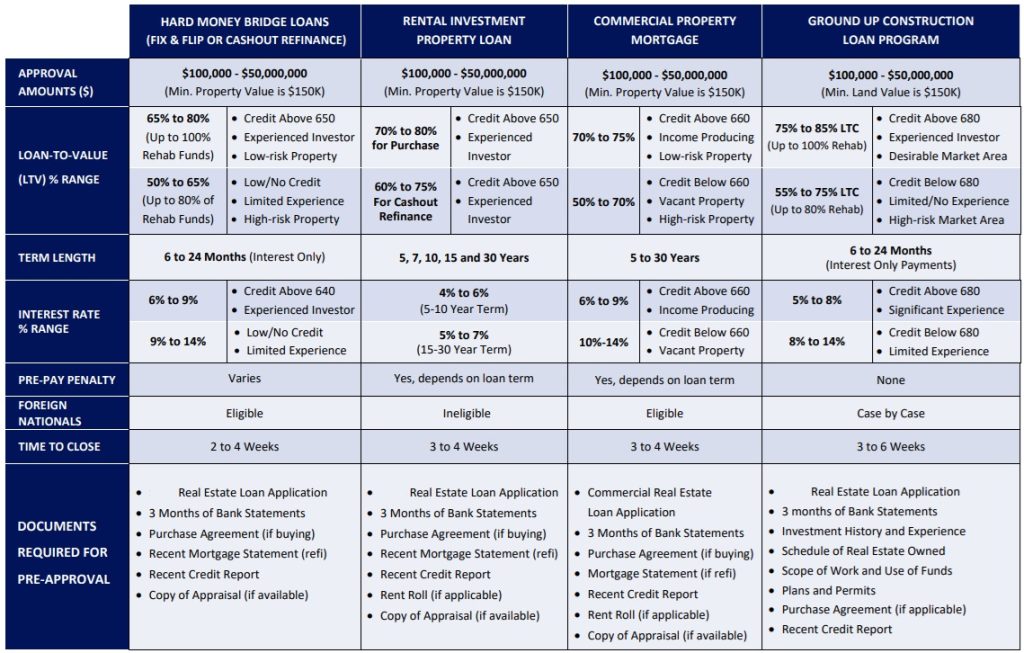

industrial/warehouse, mixed-use, retail, and more. We currently do NOT lend on primary residences, land, or mobile homes. - What is the minimum credit score? It varies depending on the loan program, but we do have no credit check options.

- How quickly can transactions close? The general range is 2 to 4 weeks, depending on factors such as: receiving required transaction information, underwriting, appraisal, title work, and providing documents needed for final approval/closing.

- Are there closing costs? Yes, all transactions will have closing costs, which may include: origination & underwriting fees, legal & title fees, property insurance, applicable taxes, etc. These vary for each loan scenario and are disclosed upfront.