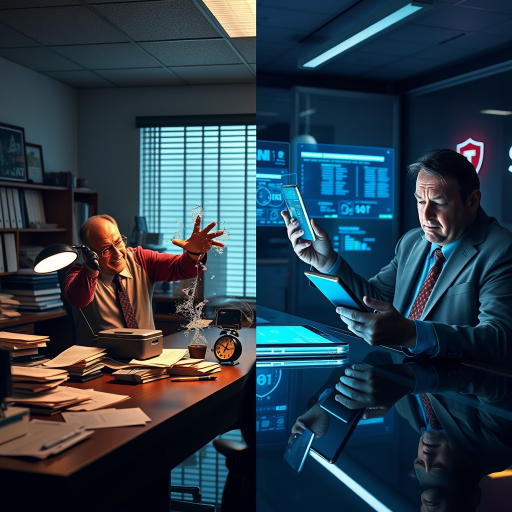

Let’s cut to the chase: getting a business loan from a traditional bank is like waiting for a dial-up modem to load a TikTok video. It’s slow, frustrating, and by the time it works, you’ve aged a decade. You need cash now—not in 2025. You need flexibility, not a contract that reads like a Shakespearean tragedy (all the fine print, none of the sonnets). You need a partner who gets it, not a robot who thinks your business is “too risky” because you sell artisanal pickles instead of oil rigs.

Enter line of credit lenders online. These financial ninjas are faster than a cheetah on a coffee IV drip, smarter than a chess-playing AI, and more secure than Fort Knox’s secret pickle stash. They’ve cracked the code to what traditional banks can’t—or won’t—deliver: algorithmic precision, military-grade security, and speed-to-funding that’d make a racehorse jealous. By the end of this article, you’ll know exactly why they’re the future—and how to snag $50,000–$250,000 in unsecured funding faster than you can say “Where’s my money?!”

The Traditional Banking Black Hole: A Tale of Woe

Traditional banks are like that one friend who’s always late, forgets your birthday, and then asks why you’re mad. Their underwriting process is stuck in the 1990s—think fax machines, 17-page forms, and a “review” process that’s basically them Googling your business name and panicking.

Storytime: My buddy Raj runs a booming vegan taco truck. When his food supplier demanded a $50k deposit for a bulk order, Raj applied for a line of credit at his local bank. Six weeks later, after submitting enough paperwork to wallpaper a small country, he got this gem: “We’re unable to approve your application due to insufficient credit history.” Spoiler: He’d been in business for seven years.

The kicker? Online lenders approved him in 24 hours using data from his Square account. Moral of the story: Traditional banks are like using a dial-up modem in a 5G world.

Algorithmic Precision: The Magic Sauce

Online lenders aren’t just faster—they’re smarter. They use algorithms that’d make a NASA engineer weep with joy. Here’s how:

- Alternative Data: They peek into your bank transactions, social media buzz, and even shipping records (because a surge in orders screams “healthy business”).

- Predictive Analytics: Imagine a crystal ball that’s actually a supercomputer predicting defaults with 95% accuracy. That’s their secret sauce.

- Real-Time Adjustments: If your sales spike, your credit limit might too—like a trusty sidekick who knows you’re about to slay.

Q: How do online lenders know I’m not a fraudster?

A: They analyze 1,000+ data points in seconds, including your LinkedIn activity, utility bills, and even the font on your invoice (no joke).

Example: A lender like Kabbage can approve a $100k line of credit in 6 hours by scanning your daily sales data—something a traditional bank might never see. Meanwhile, Raj’s bank was still debating whether “vegan tacos” were a “fad.”

Security So Tight, Even Hackers Give Up

Cybersecurity is the new black, and online lenders are dressed to kill. They’ve got:

- Encryption Stronger Than a Diamond: Your data is safer than a squirrel’s winter stash.

- AI Fraud Detection: It spots sketchy activity faster than your mom notices you’re lying about curfew.

- Certifications: Look for SOC 2, ISO 27001, or PCI-DSS. If they don’t have these, run—preferably while screaming.

Case Study: In 2023, a small bakery fell victim to a phishing scam after using a lender with weak security. Their credit line was drained faster than a milkshake at a toddler’s birthday party. The next lender they chose? One with SOC 2 certification and biometric authentication (aka “fingerprint magic”).

Speed-to-Funding: From “Maybe” to “Here’s Your Money” in Hours

Online lenders have turned funding into a Formula 1 pit stop. Here’s the breakdown:

- Application: 10-minute online forms vs. banks’ 2-hour paperwork marathons.

- Approval: Decisions in minutes, not months.

- Funding: Cash in your account within 24–48 hours—like a financial Santa Claus.

Q: Why are online lenders so fast?

A: They automate everything. No human delays, no lost documents, no “we’ll get back to you” (which translates to “we forgot about you”).

Comparison: A traditional bank might take 30 days to approve a line of credit. OnDeck? 24 hours. BlueVine? 1 business day. Meanwhile, Raj’s bank was still debating whether “vegan” was spelled with an “e” or an “a.”

The Lenders Who Get It Right (Mostly)

- Kabbage (by American Express)

- Algorithmic Edge: Real-time transaction data adjusts your credit limit like a mood ring.

- Security: SOC 2 certified, AI fraud detection, and encryption that’d make the NSA jealous.

- Speed: Funds in 6 hours.

- OnDeck

- Data-Driven: Analyzes 2,000+ data points per application—like a detective on a caffeine bender.

- Security: Bank-grade encryption and daily penetration testing (the ethical kind).

- Funding: Lines up to $500K in 24 hours.

- BlueVine

- Innovative Models: Stress-tests portfolios like a gym tests treadmills.

- Security: PCI-DSS compliance and biometric authentication (because fingerprints are the new password).

- Funding: Lines up to $250K in 1 business day.

How to Spot a Dud Lender (Before It’s Too Late)

When evaluating providers, ask:

- “What data sources do you use to assess my business?” (If they say “just your FICO score,” run.)

- “How do you protect my financial data?” (If they say “we don’t,” scream.)

- “What’s the average time from application to funding?” (If they say “3–6 weeks,” burn the application.)

Red flags include hidden fees, penalties for early repayment, and lenders who ask for your firstborn child as collateral.

The Final Word: Your Business Deserves Better Than a Dial-Up Modem

The best online line of credit lenders aren’t just faster—they’re smarter, safer, and more flexible. They’re like the financial equivalent of a Swiss Army knife—versatile, reliable, and always ready to save your bacon (or tofu bacon, in Raj’s case).

Ready to secure $50,000–$250,000 in unsecured 0% funding? Drop your email at the top of this page, and we’ll connect you with lenders who’ve swapped the dial-up modem for a 5G network.

P.S. Don’t let slow banks ruin your chances—grab that funding before it slips through your fingers like sand… or a vegan taco.