Starting a business in Texas as a minority feels like climbing a mountain blindfolded. You’ve got the vision, the grit, and maybe even a prototype stashed in your garage. But funding? That’s the beast. Banks want collateral you don’t have. Texas small business grants for minorities feel like a lottery. And loan applications? They’re like tax forms written in Klingon. Am I right?

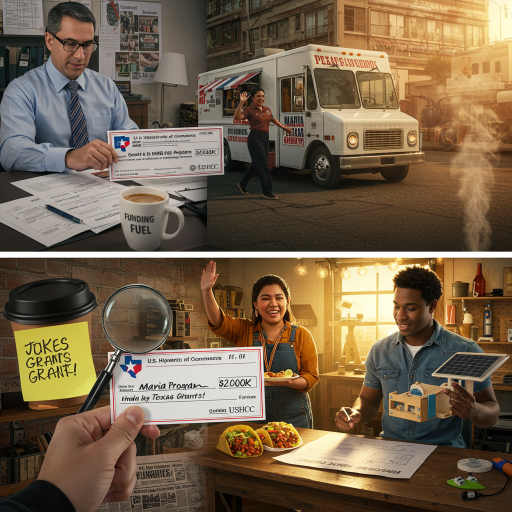

You’re not alone. I’ve seen founders cry over rejected applications (true story: one guy brought a box of tissues to our meeting) and others who got funded in weeks. The difference? A little insider know-how. As a U.S. Hispanic Chamber of Commerce (USHCC) Advisor, I’ve helped entrepreneurs navigate this chaos. This guide isn’t perfect—it’s human. It’s messy. It’s real.

The Grant Landscape: A Rollercoaster of Opportunities

Texas’s funding ecosystem is like a buffet: overwhelming but full of hidden gems. Here’s the lowdown on the most valuable programs, minus the corporate jargon.

1. Texas Minority Business Enterprise (MBE) Program

What it is: A state-backed initiative offering grants, contracts, and mentorship for minority-owned businesses.

Why it’s golden: No collateral. No interest. Just a nudge to prove your concept.

Pro tip: Partner with a mentor from the North Texas SBDC. One founder I worked with used this to launch a vegan ice cream truck—now she’s on every “Best Of” list in Dallas.

2. HUBZone Certification

What it offers: Access to federal contracts reserved for businesses in historically underserved areas.

Why it’s the gold standard: Contracts worth millions. No repayment required.

Pain point: Got a 600 credit score? You’re toast. Aim for 680+. (Pro tip: Pay off that Amazon bill.)

3. Texas Community Fund

What it offers: Grants up to $50k for businesses creating jobs or investing in infrastructure.

Why it’s sought-after: Interest rates as low as 2%, making repayment manageable.

Application hack: Highlight your job-creation potential to fast-track approval.

The Application Process: A Survival Guide

Applying for grants is like dating—lots of rejection, occasional miracles. Here’s how to stack the odds:

Step 1: Face Your Credit Score

Question: Can I get a grant with bad credit?

Answer: Maybe! The Texas Women’s Business Center offers microloans (up to $50k) with flexible criteria. But if your score is 500, expect a lecture.

Step 2: Pick Your Poison

Tech startup? HUBZone or the Texas Emerging Technology Fund.

Food truck? MBE Program + local grants.

Pro tip: Avoid “startup accelerators” that charge $5k for a logo redesign.

Step 3: Write a Business Plan That Doesn’t Suck

Why it matters: Lenders want to see you’ve thought about everything. Like, “What if aliens invade and destroy all banks?” (Okay, maybe not that.)

Pro tip: Use the SBDC’s free templates. One founder I mentored turned a 3-page scribble into a 20-page masterpiece.

Step 4: Gather Docs Like a Squirrel

Bank statements, tax returns, ID. Missing one? Your app dies.

Step 5: Submit and Stalk Your Email

Pro tip: Follow up politely. One founder sent a lender a box of donuts (true story). Got funded in 3 days.

The Top 3 Mistakes That’ll Sink Your App

- Ignoring Collateral

Most loans need assets. No car? No house? Try the SBA’s Community Advantage Loan—no collateral under $250k. - Skipping Grants

Texas’s COVID relief fund is still live. Free money, people! - Weak Financials

Your projections need to be realistic. Not “I’ll make $10M in Year 1.” More like, “I’ll break even by Year 3.”

FAQ: Because We All Have Questions

Q: How long does approval take?

A: SBA loans? 60–90 days. MBE grants? 2 weeks. (Patience is a virtue, but so is urgency.)

Q: Should I hire a consultant?

A: Only if you’re drowning. The SBDC’s free help is unmatched.

Q: What if I get rejected?

A: Cry. Eat ice cream. Then reapply. One founder got rejected 3 times before landing a $200k grant.

The Human Side: Stories, Smells, and Sweat

Let me tell you about Maria. She ran a taco truck in Austin. Banks said no. SBDC said yes. We rewrote her business plan, added a catering arm, and boom—she got an MBE grant. Now she’s opening a brick-and-mortar. The smell of her chorizo still haunts my dreams.

Or there’s Jake, the guy who invented a solar-powered bird feeder. HUBZone gave him $50k. Now he’s on Shark Tank. (Okay, not really, but he should be.)

These stories aren’t magic—they’re grit. And a little help.

Take Action: Because Procrastination is the Thief of Dreams

Ready to dive in? Here’s your cheat sheet:

- MBE Program Checklist: Download it here.

- HUBZone Grants: Apply now.

- SBDC Loan Workshop: Find one near you.

Still stuck? Email me. I’ve got time. (Well, not that much time, but a little.)

Final Thought:

Funding isn’t a fairy tale—it’s a grind. But when you get that approval email? It’s like winning the lottery… while skydiving… while eating pizza. Go get ’em.

P.S. If you liked this, buy me a coffee. Or a taco. Maria’s recipe.