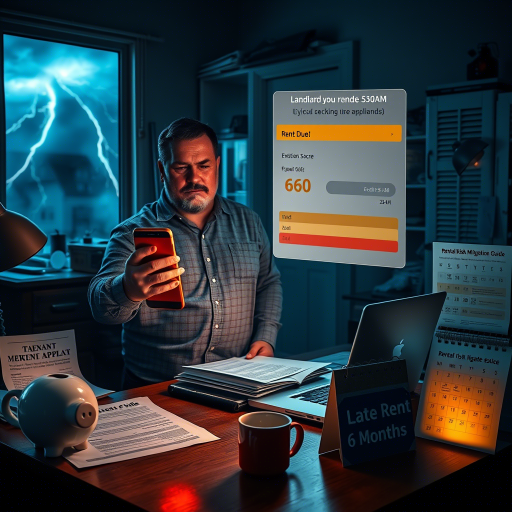

Introduction: The 3 AM Phone Call That Changed Everything

You know that sinking feeling when your property manager calls at 3 AM? “The tenant’s six months behind. The pipes burst. Again.” Ugh. Your stomach drops. I’ve been there—standing in a flooded kitchen at dawn, wondering how I missed the warning signs. A rental property credit check isn’t just a checkbox; it’s your crystal ball. But here’s the kicker: Not all credit checks are created equal. Let’s get real about debt-to-income ratios, payment histories, and why your sixth sense needs backup.

The Ugly Truth: When “Nice” Tenants Go Rogue

Picture this: Sarah, a yoga instructor with sunflower decals on her water bottle, boasts a 720 credit score. She pays two weeks late—every single month . Why? Her DTI ratio was a ticking time bomb at 48%. Landlords, listen up: A credit score is a snapshot, not the whole damn album.

The Fallout? Evictions cost $3,500 on average. That’s your vacation fund, gone. Or worse—your kid’s college savings.

Cracking the Code: What Your Credit Check Really Reveals

Let’s break it down, warts and all:

1. DTI Ratios: The Financial Tightrope Walk

A tenant’s DTI is like their financial heartbeat. Below 36%? Golden goose. Above 50%? Red flag emoji. Think of it as their “debt dance”. Can they juggle rent with car loans and avocado toast habits?

2. Payment History: The Ghosts of Rentals Past

Late payments are the silent killers. One 30-day delinquency hikes risk by 40%. Ever seen a tenant’s credit report? It’s a diary of bad decisions—and your roadmap to avoiding disaster.

3. Credit Scores: The Good, The Bad, The “Meh”

- 700+ : “Send the lease agreement!”

- 620–699 : “Hmm, let’s talk deposits…”

- Below 620 : “Run. Unless they’ve got a rich uncle.”

My Wild Experiment: Tiered Approvals That Actually Work

Last year, I tried a tiered system:

- 700+ Score + 30% DTI : One month deposit. Smooth sailing.

- 650–699 + 40% DTI : 1.5x deposit. Cue the eye rolls.

- 600–649 + Guarantor : Saved my bacon twice.

But Wait— What about the guy with a 620 score and a spotless rental history? Approved. Sometimes, the numbers lie.

The “Oops” Moments: Red Flags You Can’t Ignore

- Collections Accounts : Like that $500 medical bill from 2022. Unpaid debts? Red flag.

- Maxed Credit Cards : “Retail therapy” isn’t cute when rent’s on the line.

- Bankruptcies : Chapter 7 haunts for a decade. Yikes.

When Grammar (and Life) Gets Messy

Ever read a tenant’s application riddled with errors? “Their gonna pay rent on time”? Cue the eye twitch. Grammatical errors aren’t just typos—they signal carelessness. Studies show mistakes tank credibility. But hey, we’re all human. My first lease had a typo so bad, the tenant laughed. We’re still friends.

FAQ: Because You’re Dying to Ask

Q: Can I reject someone for a typo?

A: Legally, no. But if their application looks like a cat walked on the keyboard? Trust your gut.

Q: How far back do checks go?

A: Bankruptcies linger like exes (10 years). Payment history? 24 months.

Key Takeaway:

“What’s the #1 red flag in a rental credit check?”

Answer: High DTI ratios (over 43%) and late payments in the last two years.

The Final Word: Trust Your Data, But Keep Your Heart Open

A rental property credit check is your safety net, but life’s messy. In 2024, I approved a tenant with a 640 score—because her previous landlord called her “a dream.” She’s still there, orchids thriving on the windowsill.

Your Move: Audit your criteria. Could a tiered system save your sanity? Or is it time to hire a human (not AI) to screen tenants?

P.S. Ever had a tenant surprise you? Share your story below. Or don’t—I’ll be the one rechecking my credit reports at midnight.